Employee Financial Assistance in Kenya

MantraCare – Kenya’s top employee assistance platform offering financial wellness, legal assistance, employee well-being & more

Want to Launch Financial Assistance?

"*" indicates required fields

What is Financial Assistance for employees?

Financial Assistance for employees in Kenya refers to a program provided by employers to address the financial concerns of their employees or their family members. It involves offering consultations and guidance to employees regarding their financial well-being. These consultations may cover various topics such as budgeting, debt management, savings, investment options, insurance, and other relevant financial matters.

The objective is to empower employees with knowledge and resources to make informed financial decisions, improve their financial literacy, and alleviate any financial stress they may be facing. By offering such assistance, employers aim to enhance the financial stability and overall satisfaction of their workforce.

Benefits of Financial Wellness Programs

- Increased Productivity

Employees exhibit reduced distractions & enhanced capacity to maintain focus on organizational goals.

- Increased Productivity

- Decreased HR Costs

There is a decrease in garnishments, fewer requests for pay advances, and reduced reliance on assistance programs among employees.

- Decreased HR Costs

- Decreased Theft

Instances of theft, driven by desperate circumstances rather than malicious intent, such as borrowing money to cover expenses

- Decreased Theft

- Decreased stress related illnesses and absenteeism

including issues related to substance abuse, accidents, & a higher frequency of tardiness among employees.

- Decreased stress related illnesses and absenteeism

- Increased ability to communicate & cooperate,

heightened ability to receive and follow instructions from supervisors.

- Increased ability to communicate & cooperate,

Get Comprehensive Financial Assistance at MantraCare, Kenya

1. Bankruptcy

Helps employees navigate financial difficulties and develop strategies to avoid bankruptcy.

2. Budgeting

Helps employees create & manage budgets to effectively track & control their spending

3. Retirement Planning

Comprehensive retirement planning , create a roadmap to secure financial future

4. Major life event plan

Financial advice & planning for significant life events such as weddings, adoptions, & divorces.

5. Debt Management

Aids in lowering interest rates & consolidating debt, providing strategies to regain finance control

6. Fund Planning

Assists in developing customized plans to save for events such as child education, buying home, etc.

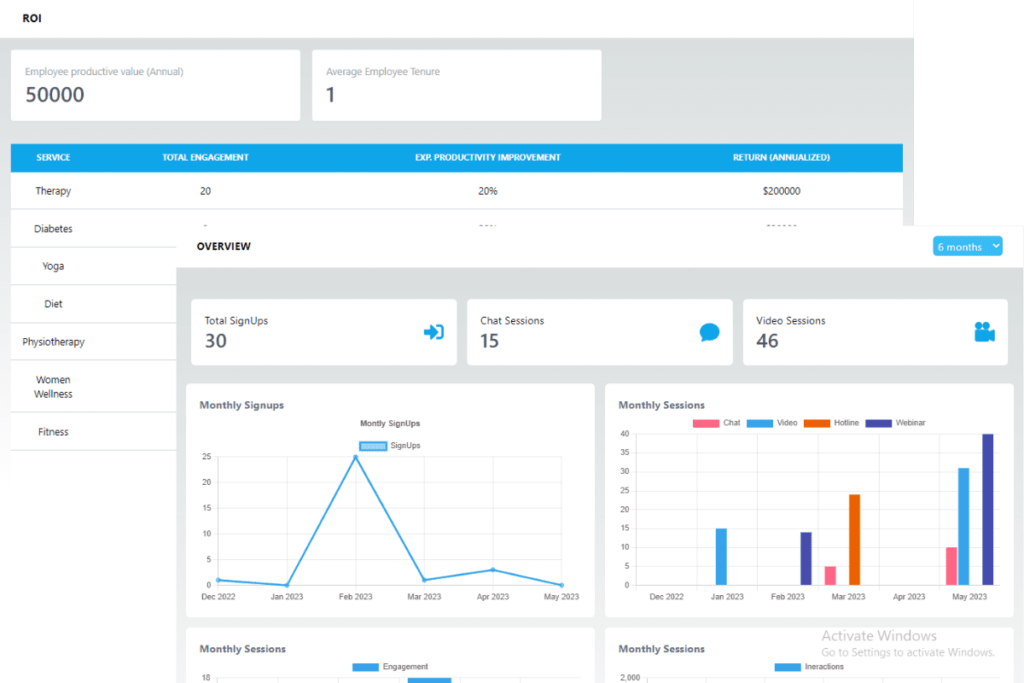

Live Reporting of your Employee's Financial Prudence

At MantraCare Kenya, we provide live reporting on your employees’ financial stability and how they are benefiting from financial assistance. Our comprehensive tracking system allows us to:

- Monitor their financial milestones, such as debt reduction, savings growth, and improved credit scores.

- Regularly assess their progress and provide personalized feedback and guidance to ensure they are on track toward their financial goals.

- We empower our employees to see tangible results, ultimately fostering a sense of financial well-being and motivation within your workforce.

Global Reach

MantraCare has its presence in major cities in Kenya

MantraCare has been offering financial assistance plans to companies in Kenya for the past 10 years. We have presence in all key locations in Kenya including Bungoma, Busia, Butere, Dadaab, Diani Beach, Eldoret, Emali, Embu, Garissa, Baragoi.